Well that worked out nicely! GOOGL gapped up quite nicely this morning. I sold my 4 GOOGL June 715 calls for $28.50 shortly after the marked opened. This was before the entire market decided to lay an egg.

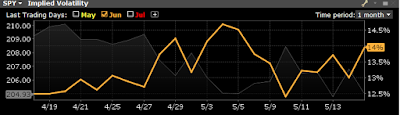

I'm not sure if volatility will continue its trend up, but it's certainly higher now than it was a week ago. With the increase in volatility, I decided to sell some SPY and QQQ straddles as well. I'll always sell straddles on down days. I'll take profits at 25-30% of initial credit. On the flip side, I'll get out of dodge if the spread expands to 2.5x (ie. SPY straddle expands to $17).

MCD got caught in the downward momentum of the market. My

target hopes/prayers/best case scenario for MCD for the end of the week (and May options) is between $129-131. My MCD position is already +delta, but I decided to sell some more short-term puts anyways in the hopes the market's zigzagging will continue tomorrow.

No comments:

Post a Comment