Pinning the tail on the donkey. It's a classic birthday game that I'm sure we've all played (or at least a derivative of the game) . [Heh heh...did you see what I did there?]

A calendar spread is the options version of the game. The objective is to guess what the price of the underlying will be at a certain point in time. A long calendar spread is one of many strategies a trader can employ if a trader believes the underlying stock will remain range-bound for a period of time. A calendar spread can use either calls or puts. The position involves a long call (put) position at a given strike and a short call (put) position at the same strike but with an earlier expiry and is generally opened for a net debit.

The objective of the spread is for the underlying stock to settle as close to the strike price as possible when the short option expires. When the short option expires at-the-money (ATM), the spread between the long option and the short option is maximized. If the short option expires in-the-money (ITM), the delta of the short option is 1, while the delta of the long option is less than 1. Therefore, the spread between the options will decrease for every tick the short option is ITM. On the flip side, if the short option expires out-of-the-money (OTM), the value of the short option is still zero, but the value of the long option will be lower. Therefore, you can see that the bliss scenario for the calendar spread is for the underlying to pin the strike of the short option at expiry. This is what happened for me with SPY this week.

On May 25, SPY was trading a little over $209 while I was short a couple of straddles on the SPY with 203 and 206 strikes. My SPY positions were -delta, meaning my positions would make money if SPY went down, but would lose money if SPY went up. I wanted to adjust my SPY position to provide myself with some upside risk protection in the event SPY continued its ascent and remained range-bound around $210-212. I entered into a long calendar spread by:

- buying SPY July (17) 210 puts

- selling SPY June (10) 210 puts

The spread cost me $2.45. It would more than offset any straddle losses if SPY settled at $210 around expiry, however the hedge would lose its efficacy above $213 or so. Over the first few days, the spread became profitable. Calendar spreads are generally very slow moving (ie. they make/lose money very slowly). However, things accelerate as you get closer to the short expiry. Both theta and gamma increase. Theta represents time decay. A long calendar spread is +theta therefore the spread makes money with the passage of time. Gamma represents the change in delta as the underlying moves. A long calendar spread is -gamma and risks losing money if the underlying starts to move rapidly in any direction. Because of gamma risk, I typically don't hold calendars until expiry of the short option, however in this instance I elected to roll the dice.

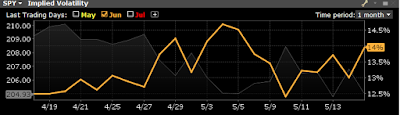

The short side of my spread expired on Friday, June 10. SPY closed on Thursday at about $212 and gapped down on the Friday open. SPY meandered around $210 and was pinned to my short strike--the absolute perfect scenario. I closed the calendar mid-day with a credit of $3.69 for a net profit of $3.69 - $2.45 = $1.24 or about 50% of my initial debit. A calendar spread home run! Near market close, the spread actually traded at $4.00, however I was still more than pleased with my 50% profit. What helped the position even more was the expansion of volatility. A calendar spread is the only directionless strategy which benefits from volatility expansion, however this is outside the scope of this article.

The calendar spread win more than offset all of my straddle losses for the month (and then some!) which was the objective of this trade. Many find the strategy boring but for whatever reason I have an affinity to this position. Since calendar spreads benefit from increasing volatility, it's a strategy that should be considered in low volatility environments like we generally have today.

Standard June options expire next week so I'll have some more postmortems to share as it'll be a busy week of closing positions. In particular is my GOOGL call calendar spread and my MCD calendar/diagonal. The MCD trade has been a grind with a ton of adjustments which I'll recap next weekend.